GOCL Corporation Ltd is engaged in the business of Energetics, Mining & Infrastructure Services and Realty.

Let’s understand GOCL Corps business segments. The company operates in 5 business segments. These are:

1. Energetics: GOCLCORP produces initiating devices (detonators) and accessories, specifically designed for mining and infrastructure projects. These devices play a crucial role in triggering explosives loaded in boreholes or on the surface. Current Capacity in Energetics division is 192 million units.

2. Explosives: Company’s wholly owned subsidiary IDL Explosives Limited, is a leading manufacturer and supplier of packaged and bulk explosives, specifically designed for mining and infrastructure projects. GOCLCORP aims to optimize the utilisation of Bulk Plants, ensuring enhanced capacity usage, and to expand our customer base for both Bulk and Cartridge Exports. Current Capacity in explosives division is 270,000 MT and Explosive support silos of 66,000 MT.

3. Electronics: GOCLCORP aims to firmly establish its presence in the EV charger space. By leveraging expertise and technological advancements, it aims to become a prominent player in the market for electric vehicle charging solutions. Through strategic partnerships, innovative product offerings, and a customer-centric approach, it will position itself as a preferred choice for EV charging infrastructure.

GOCLCORP has entered in to an MOU with Gulf Oil Lubricants India Limited and Ashok Leyland Limited to develop and manufacture future ready EV chargers and auto electronics parts. The facility has been augmented with additional 8000 sft to accommodate new orders.

4. Special Projects: GOCLCORP’s metal Cladding division specialises in addressing critical industry needs through a unique explosive-based method of bonding dissimilar metals.

Company has absorbed Transfer of Technology (TOT) from Defense Research and Development Organisation (DRDO) for Canopy Severance System (CSS).

The 2.1 Seconds Delay Pyro for Brahmos project with required modification in specification as per STAR DRDL project developed, conducted trials and successfully supplied to DRDL for STAR project and further orders are expected in F24.

5. Real Estate: GOCLCORP is exploring various options including monetization of Ecopolis project at Bengaluru. Ecopolis is a commercial project in Bengaluru is spread over 14.54 lakh square feet area.

At Kukatpally, 44 acres of land were sold for a consideration of Rs. 451 crores and the sale proceeds were deployed profitably in FY23. The company has further 242 acres of land bank in Hyderabad.

GOCLCORP is also actively exploring opportunities for the development of a warehousing project at its land in Bhiwandi (40 acres) to capitalize on emerging business opportunities.

Further, through its overseas subsidiary HGHL, your Company has made an investment of USD 24 million in the restoration and development of the historical and marquee Old War Office (OWO) project located in Central London, to convert it into a super luxury hotel and luxurious residential apartments. To be operated and managed by the iconic Raffles Hotels, which ranks among the top 10 hotel brands in the world. This project is expected to be completed in the second quarter of FY24. The Residences have already received a tremendous response achieving the highest sale price per sq. ft. for residential projects in Central London.

To summarize there are 4 tailwinds which could add substantial revenue / profitability / cash flows to GOCLCORP. These are:

1. MOU with Gulf Oil Lubricants India Limited and Ashok Leyland Limited to develop and manufacture future ready EV chargers and auto electronics parts.

2. Transfer of Technology (TOT) from Defence Research and Development Organization (DRDO) for Canopy Severance System (CSS).

3. 2.1 Seconds Delay Pyro for Brahmos project.

4. Pay-out from restoration and development of the historical and marquee Old War Office (OWO) project located in Central London.

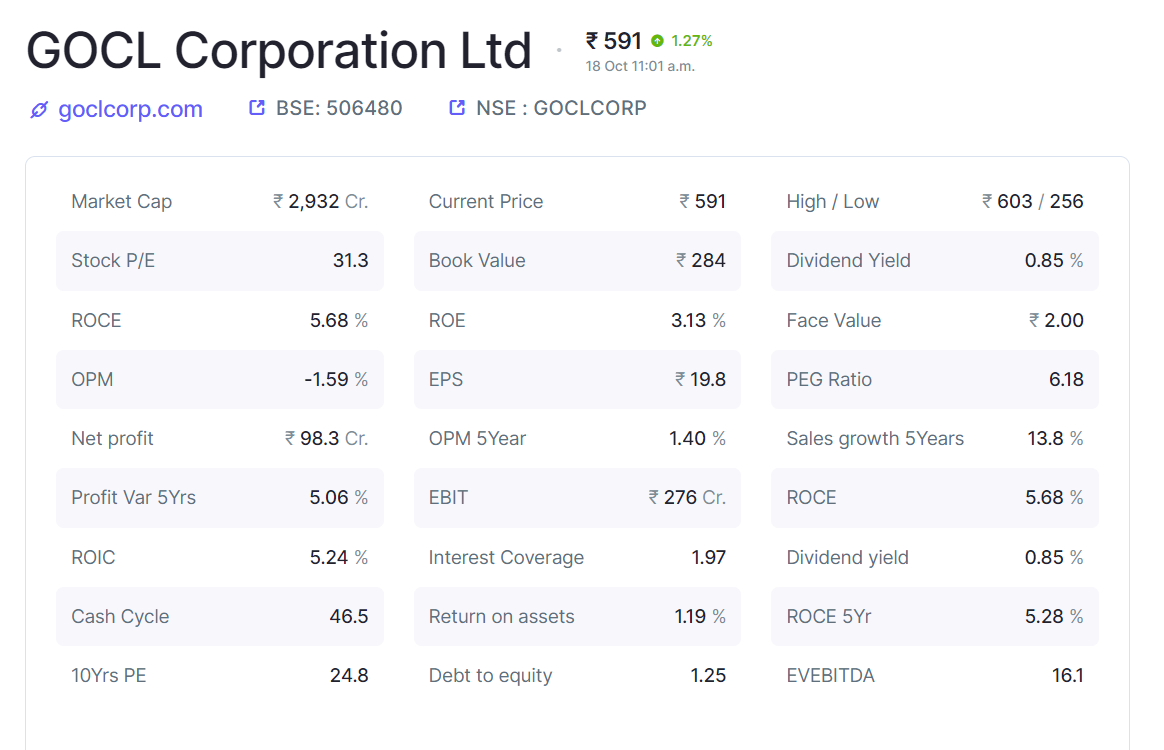

Valuation

Despite these tailwinds let us remain cognizant of the fact that the current operating business is a low margin business and does not contribute significantly to company’s valuation.

Company’s market cap is driven by the land parcel in the company.

As per my last interaction with the company the value per acre is estimated at Rs.18 crores per acre. Even if we were to be extremely conservative, and take a 70% discount to this assumption, the value of land alone would be ~2000 crores.

Current Mcap of the company is ~3000cr. It is an asset play worth looking out for which can transform into a stock in an industry with heavy tailwinds!

Disclaimer:

PARTH KOTAK (PROPRIETOR: PLUS91) is a SEBI Registered (SEBI Registration No. INA000018081) Investment Advisory Firm. The research and reports express our opinions which we have based upon generally available public information, field research, inferences and deductions through are due diligence and analytical process. To the best our ability and belief, all information contained here is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable. We make no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results obtained from its use. This report does not represent an investment advice or a recommendation or a solicitation to buy any securities.